The Normal DeFi Index

The Normal DeFi Index is a crypto index composed of 34 of the best cryptocurrencies empowering decentralized finance projects such as lending, staking, swapping, and more.

Overview

The Normal DeFi Index is a crypto index composed of the 34 best cryptocurrencies empowering decentralized finance projects such as lending, staking, swapping, and more. DeFi stands for decentralized finance which is the largest movement within crypto. DeFi seeks to revolutionize our financial markets to make them more fair, accessible, and efficient by connecting us directly with each other rather than going through middle-men institutions.

Index Mission

The mission of the Normal DeFi Index is to capitalize on the growth of DeFi as hundreds of billions of dollars flow into it each year. There are many ways to generate returns using DeFi methods such as lending or staking, however, this index only seeks to own the underlying assets for maximum value capture.

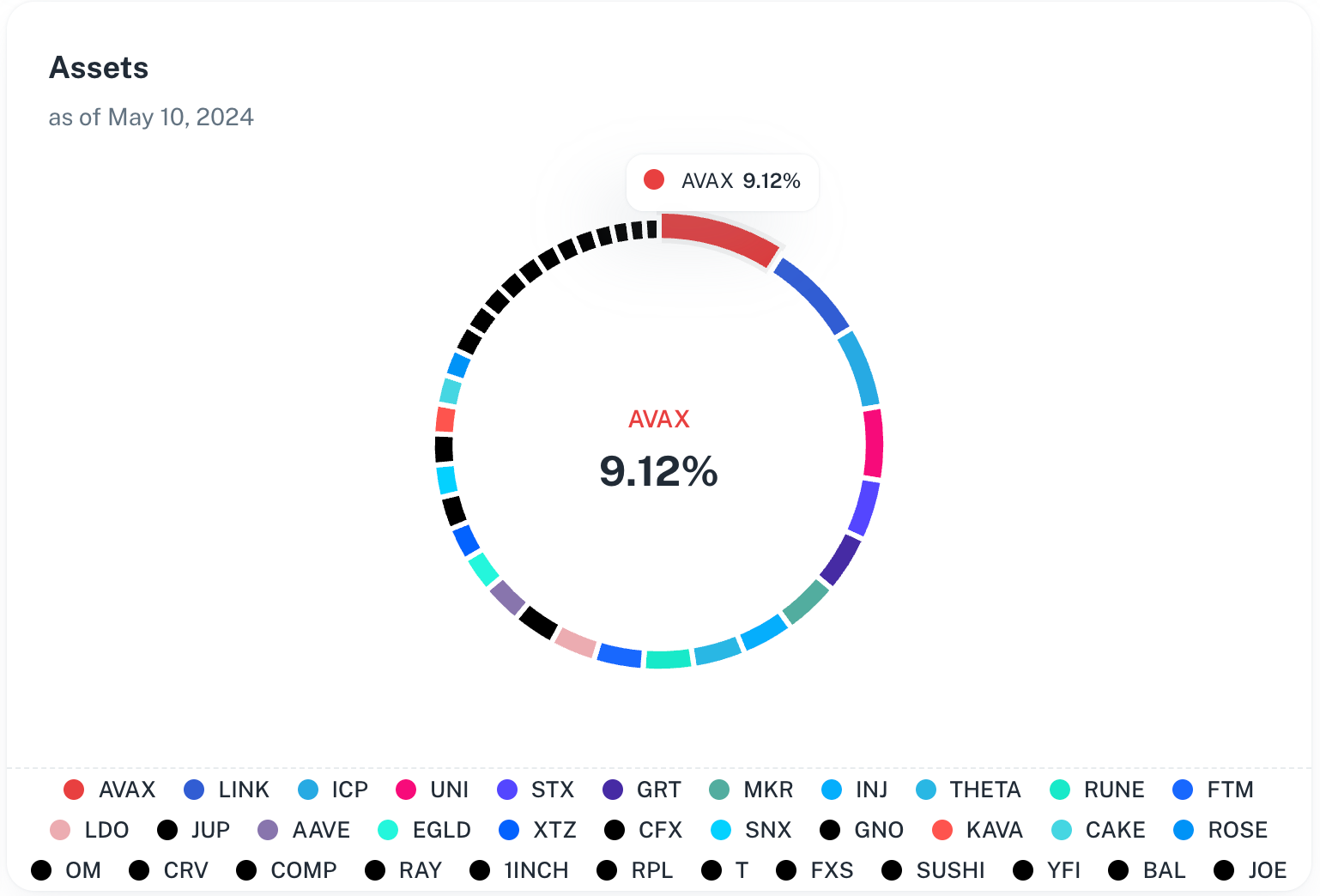

Assets

The Normal DeFi Index is composed of the following 34 assets:

- Avalanche (AVAX)

- Chainlink (LINK)

- Internet Computer (ICP)

- Uniswap (UNI)

- Stacks (STX)

- The Graph (GRT)

- Maker (MKR)

- Injective (INJ)

- Theta Network (THETA)

- THORChain (RUNE)

- Fantom (FTM)

- Lido DAO (LDO)

- Jupiter (JUP)

- Aave (AAVE)

- MultiversX (ELGD)

- Tezos (XTZ)

- Conflux (CFX)

- Synthetix (SNX)

- Gnosis (GNO)

- Kava (KAVA)

- PancakeSwap (CAKE)

- Oasis (ROSE)

- MANTRA (OM)

- Curve DAO Token (CRV)

- Compound (COMP)

- Raydium (RAY)

- 1inch Network (1INCH)

- Rocket Pool (RPL)

- Threshold (T)

- Frax Share (FXS)

- SushiSwap (SUSHI)

- yearn.finance (YFI)

- Balancer (BAL)

- JOE (JOE)

Our team has carefully selected these assets to appropriately encompass the mission of the index while maintaining integrity and security.

We review each Normal crypto index monthly to assess if assets should be added or removed. This process ensures our indexes accurately reflect the market to achieve their desired investment goal.

We recommend a minimum investment of $95 for the Normal DeFi Index to ensure all assets are purchased successfully.

Allocations

Asset allocations for our indexes are updated daily, so please visit the details page for this index for the most up-to-date information.

As of today, May 10, 2024, the top 10 Normal DeFi Index allocations are:

- Avalanche (9.12%)

- Chainlink (7.22%)

- Internet Computer (5.93%)

- Uniswap (5.29%)

- Stacks (4.63%)

- The Graph (4.16%)

- Maker (3.98%)

- Injective (3.74%)

- Theta Network (3.71%)

- THORChain (3.63%)

- Please visit the Normal DeFi Index for the rest

Returns

Over the past year, the Normal DeFi Index has returned 48.13%. Compared to the S&P 500’s annual return of 28.12%. It’s important to note that during this time, the max drawdown of the Normal DeFi Index was around 39% in September of 2023.

Monthly returns currently sit at -24.70% and quarterly returns are -9.97%, with the S&P 500 equivalents being 2.7% and 10.8% respectively.

Fees

All crypto indexes on Normal have a 0.50% investment fee. Our fee structure is slightly different than the traditional expense ratio you may be familiar with due to the unique value our indexes provide.

By investing in crypto using a Normal index, you can enter the market with 6x less fees than you’d otherwise pay using an exchange or on-ramp.

How to Invest

If this is your first time using Normal, setting up your account will take 5-10 minutes using our provided guides and walkthroughs.

Otherwise, investing in the Normal DeFi Index takes just a few seconds:

- Open the Normal DeFi Index

- Click “Invest” on the left-hand side

- Enter the amount you’d like to invest along with your desired exchange

- Review our fee and your order previews

- 🎉 Invest!

Investments for the Normal DeFi Index typically take around 25 seconds to execute. You can track your investment's progress in your Normal Dashboard.

Connect with us

Thank you for learning about the Normal DeFi Index. If you have any questions or need help with your account or investment, please feel free to connect with us via support@normalfinance.io, our Twitter, live chat (bottom-left blue button), or our Discord below.

Normal Discord